Tax

In this tab, you can define how taxes are calculated, displayed, and applied to different products.

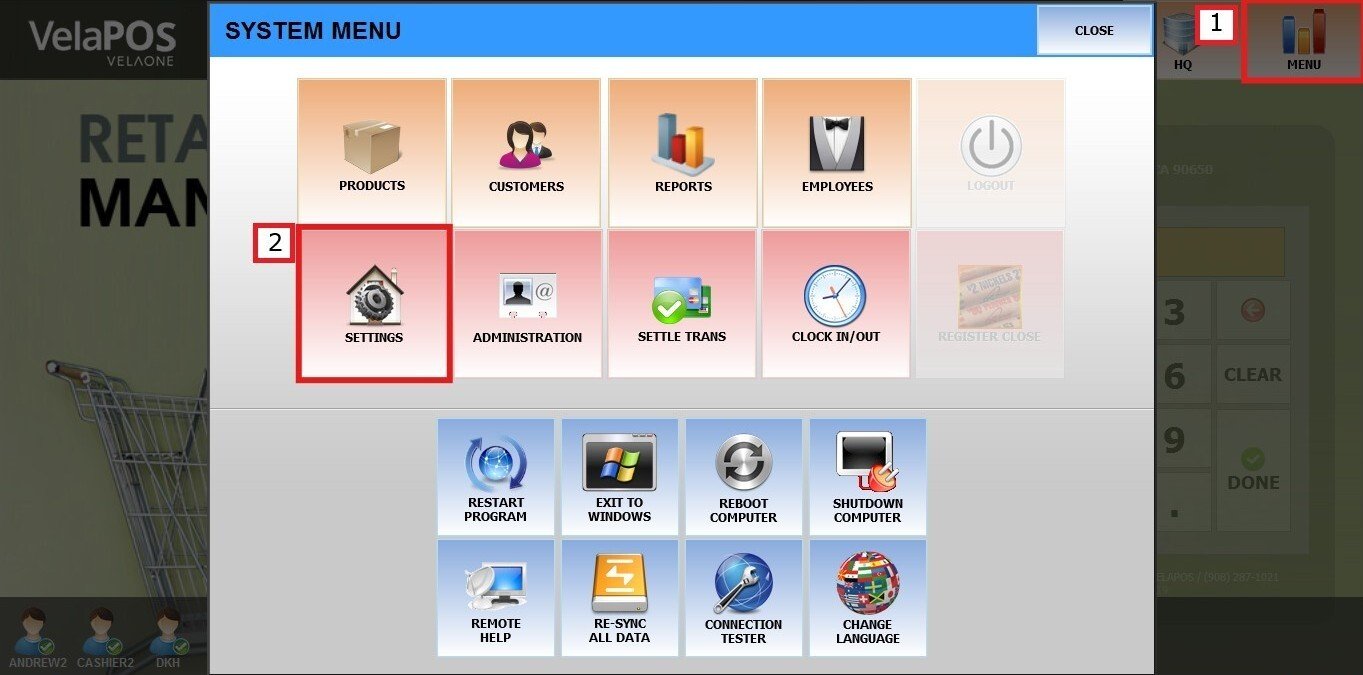

Main Screen> MENU> SETTINGS> PAYMENT> TAX

Go to MENU and press SETTINGS.

Under PAYMENT, select TAX.

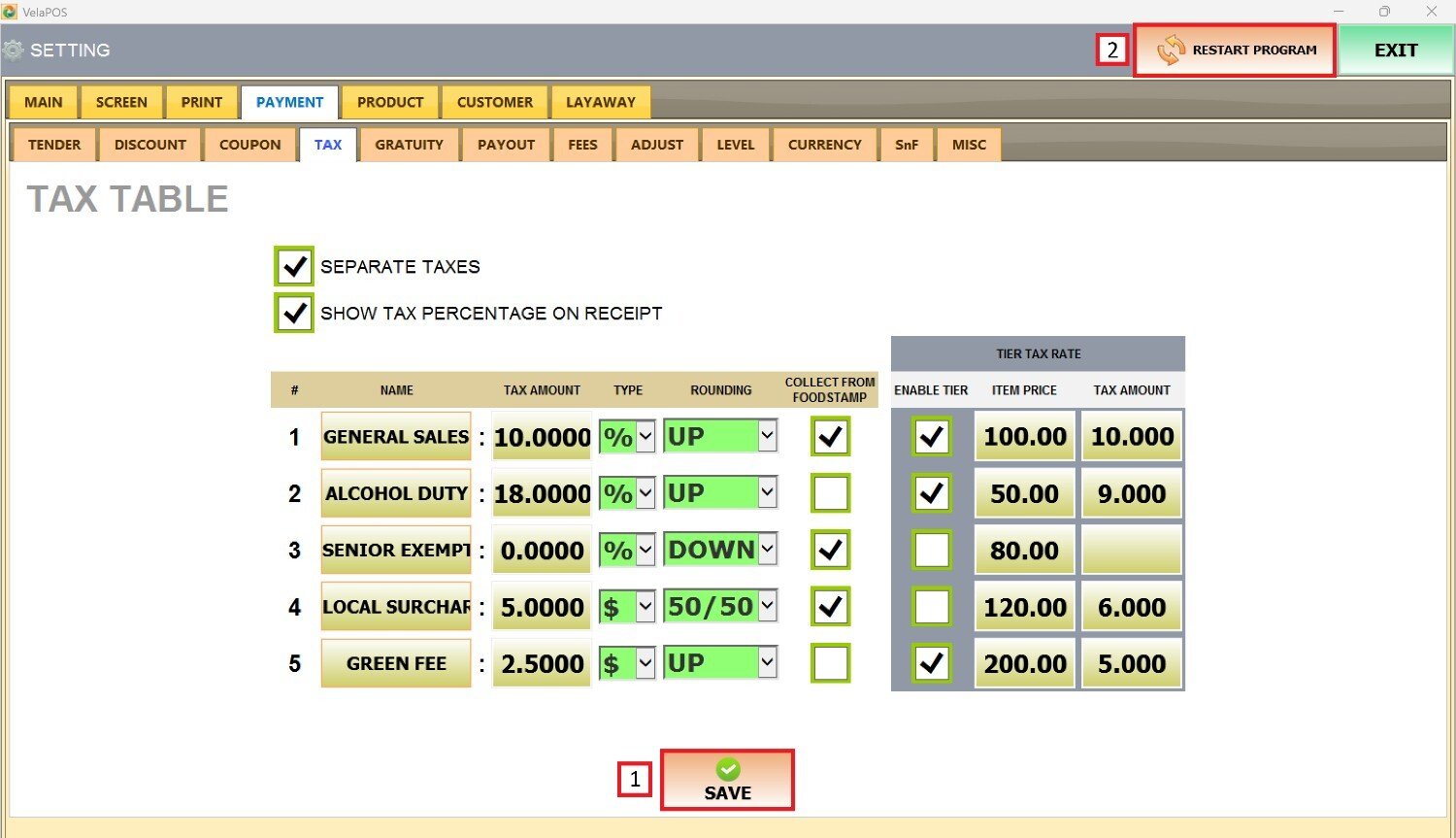

Tax Display Settings

This section controls how taxes are calculated and shown.

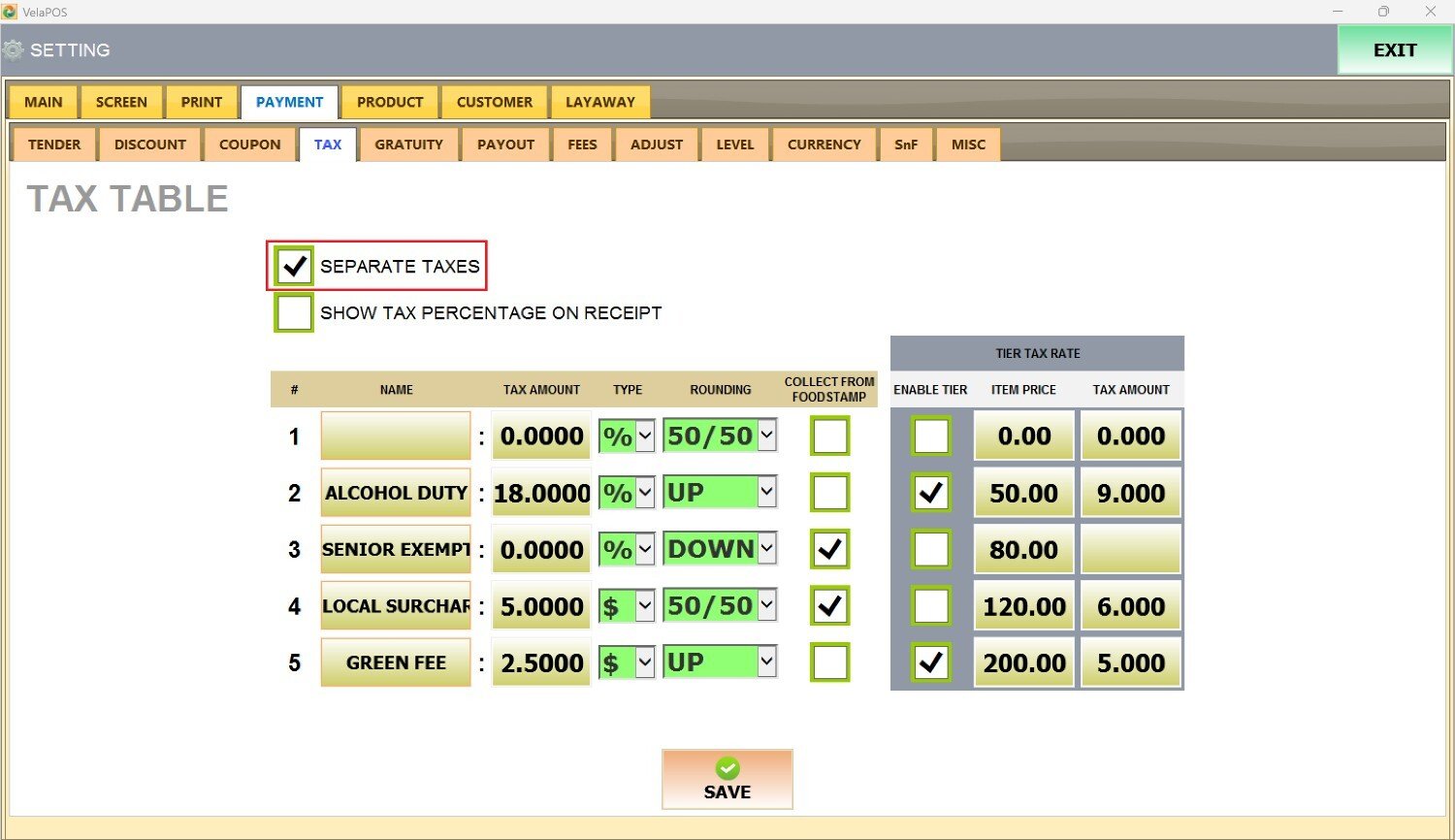

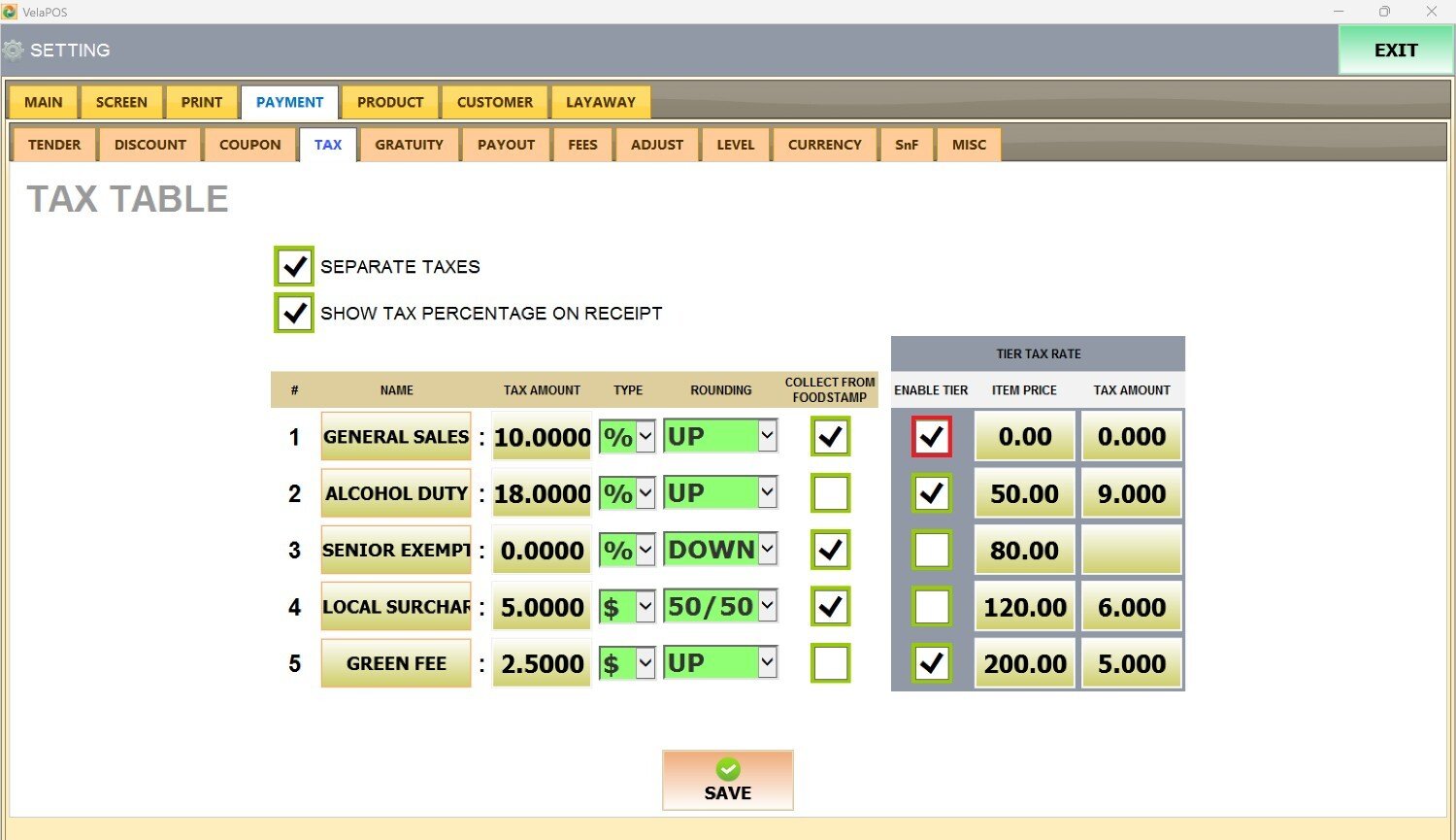

SEPARATE TAXES

Determines whether taxes are calculated and displayed individually instead of as a combined total.

Check the box next to the title to enable the function.

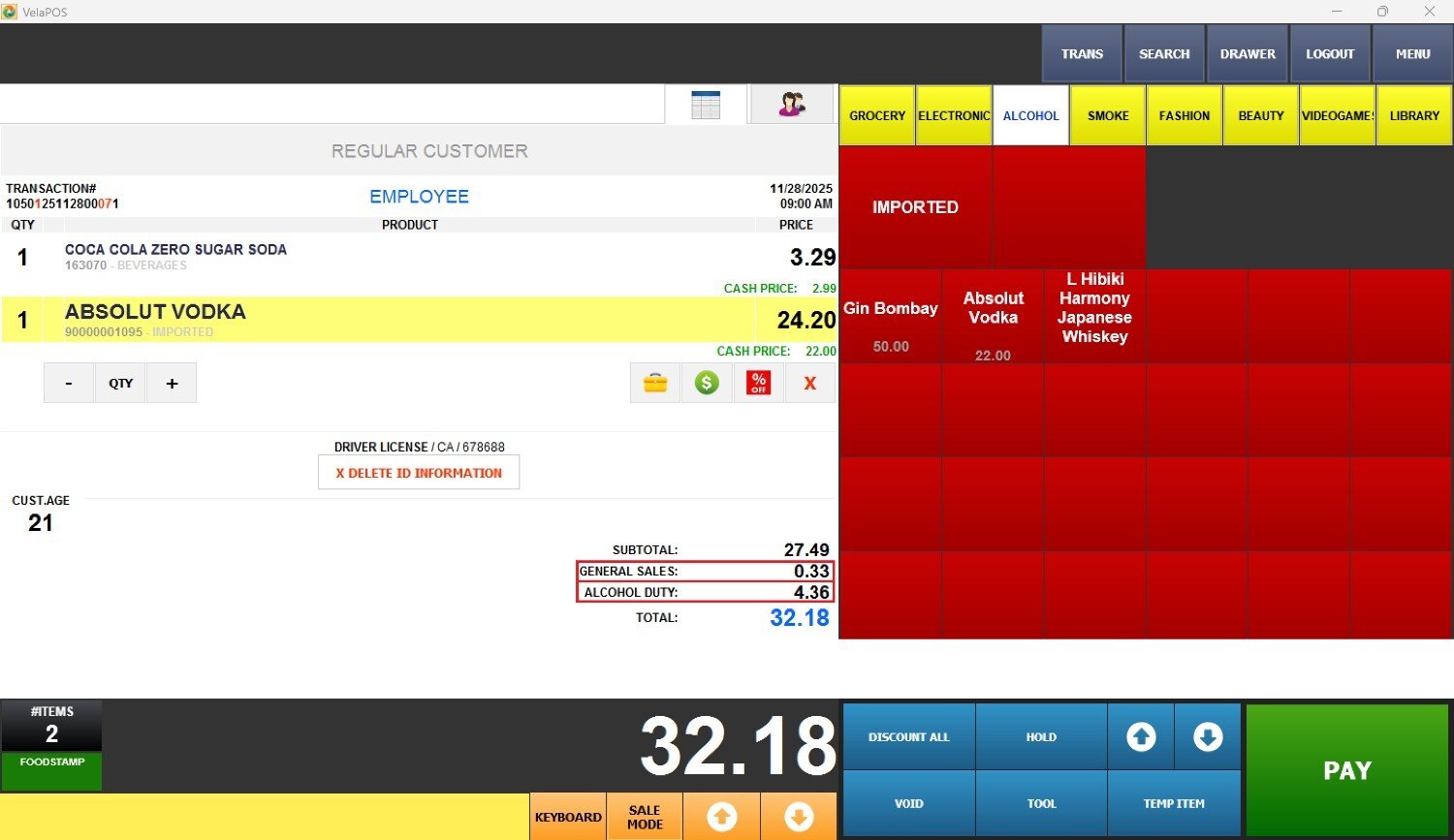

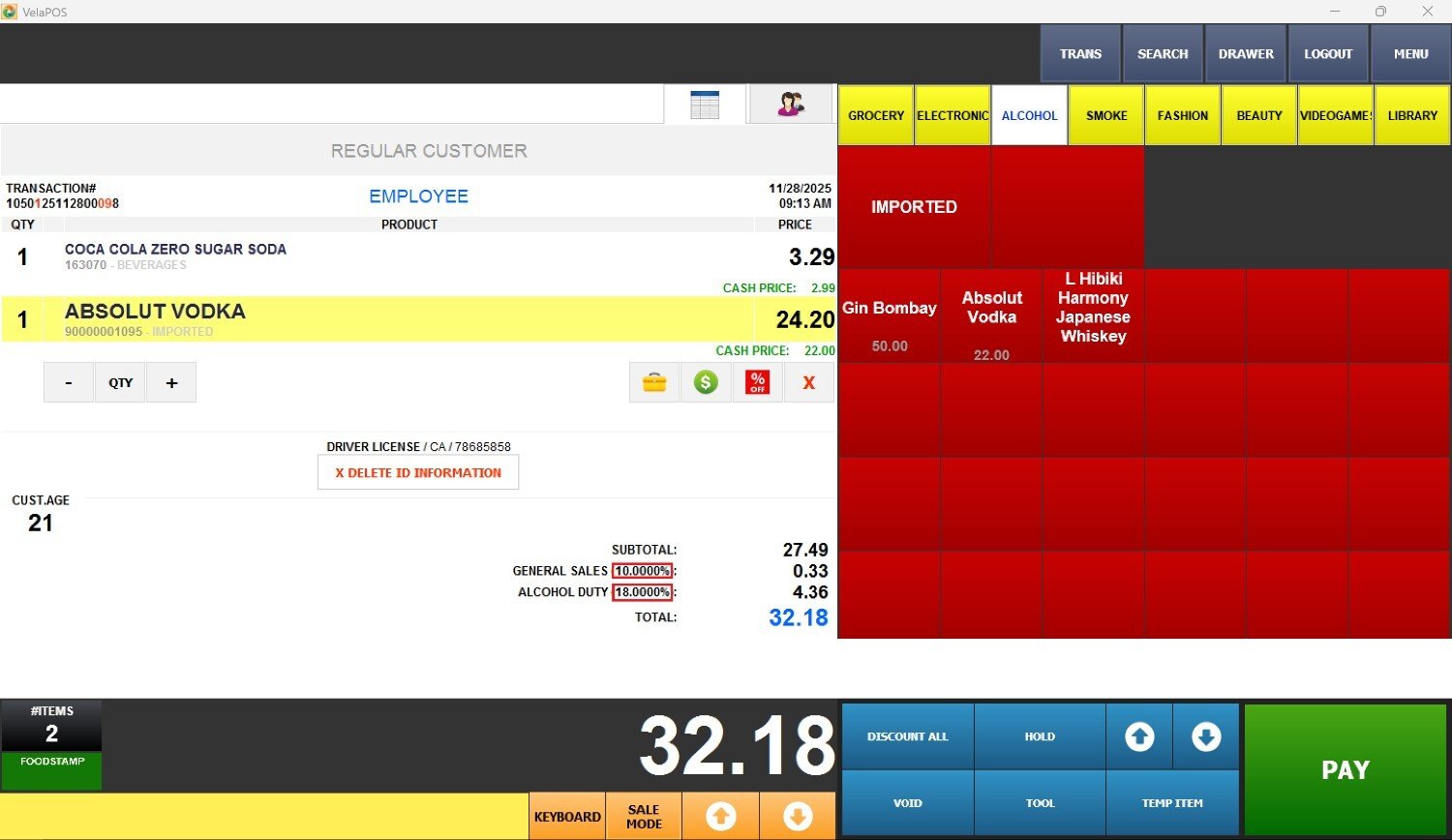

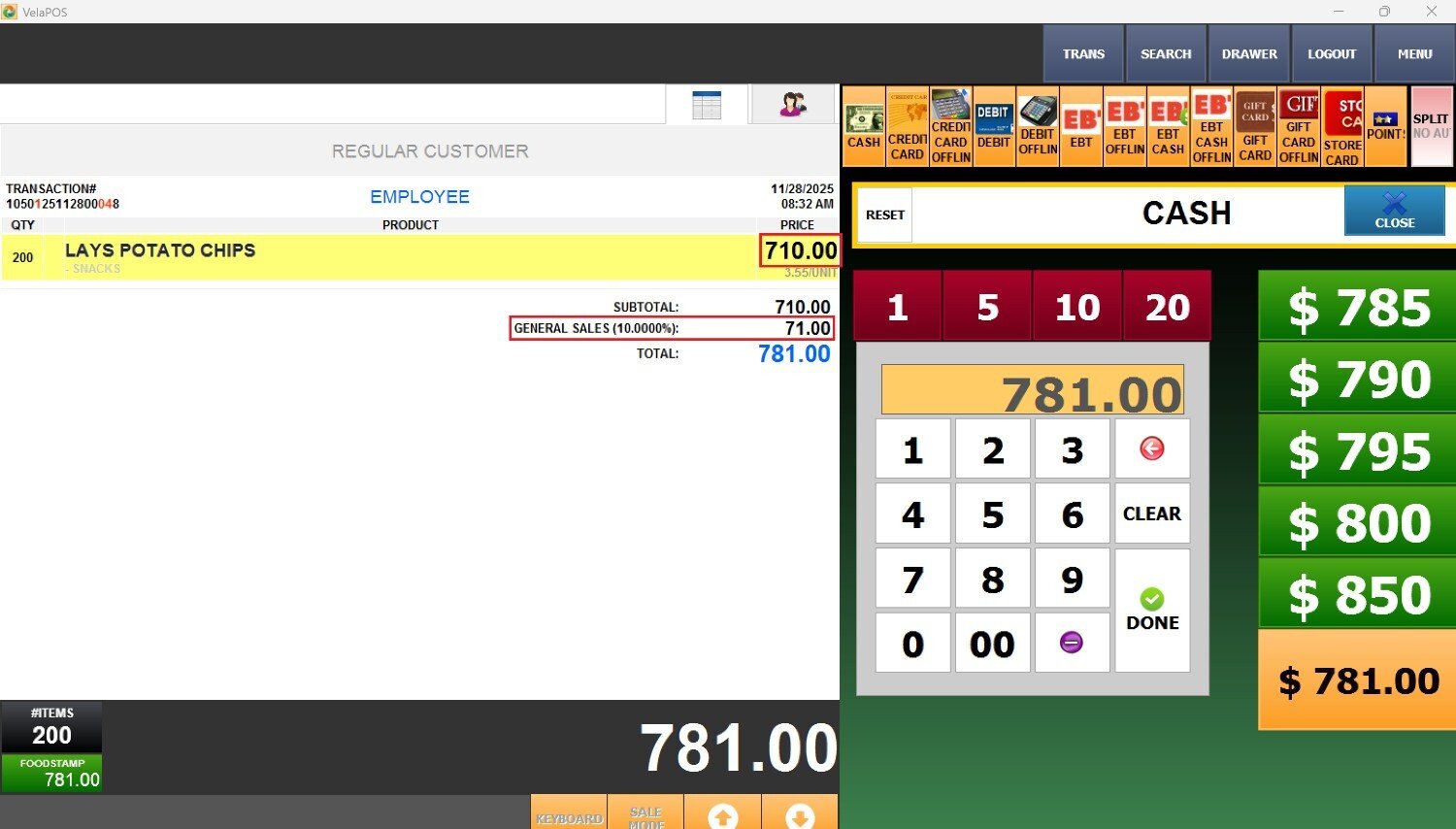

Result:

Taxes are shown separately rather than grouped together.

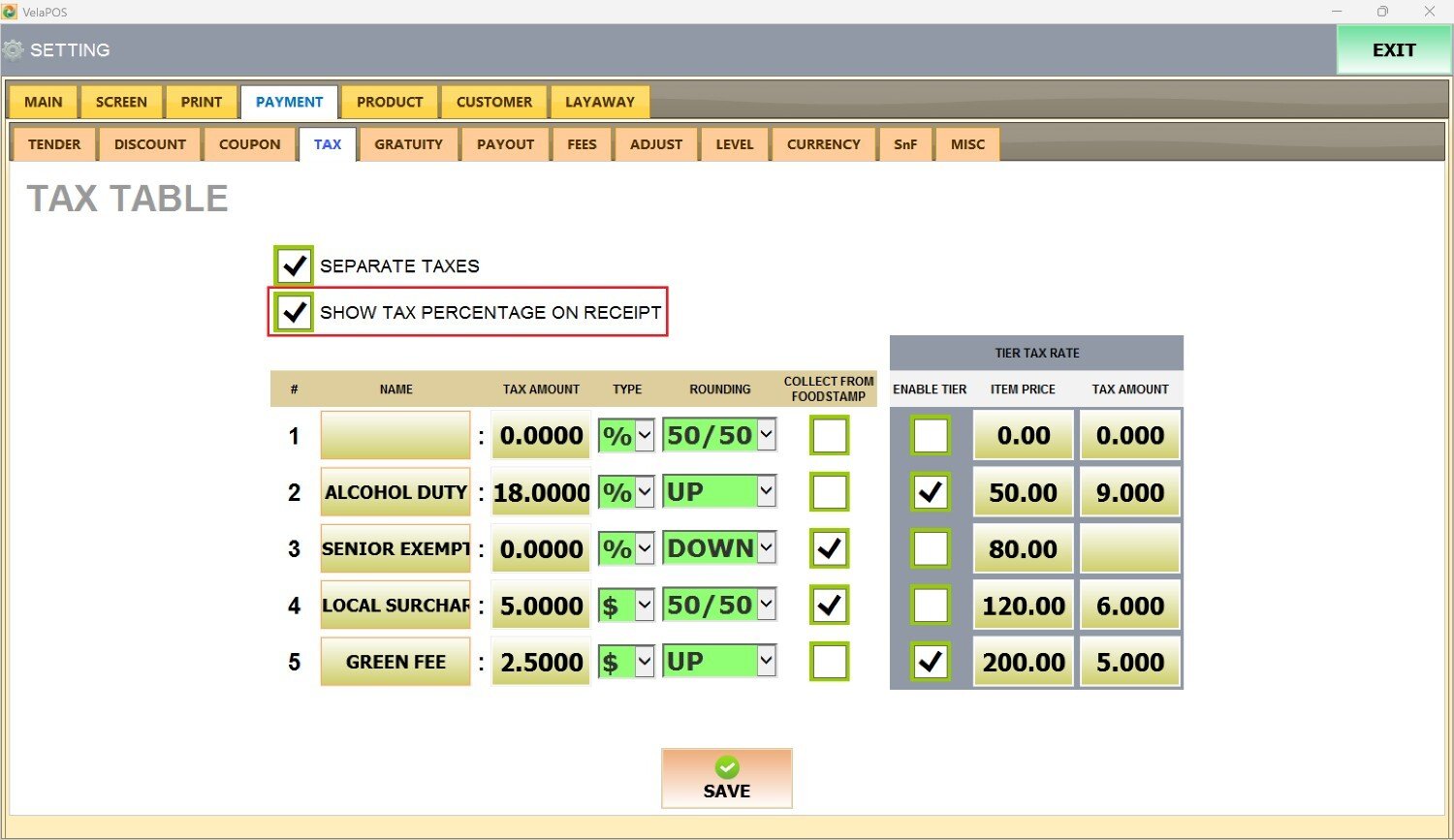

SHOW TAX PERCENTAGE ON RECEIPT

Controls whether the tax rate is displayed next to each taxed item on the printed receipt.

Check the box to enable this option.

Result:

The tax percentage is shown next to each applicable item on the receipt.

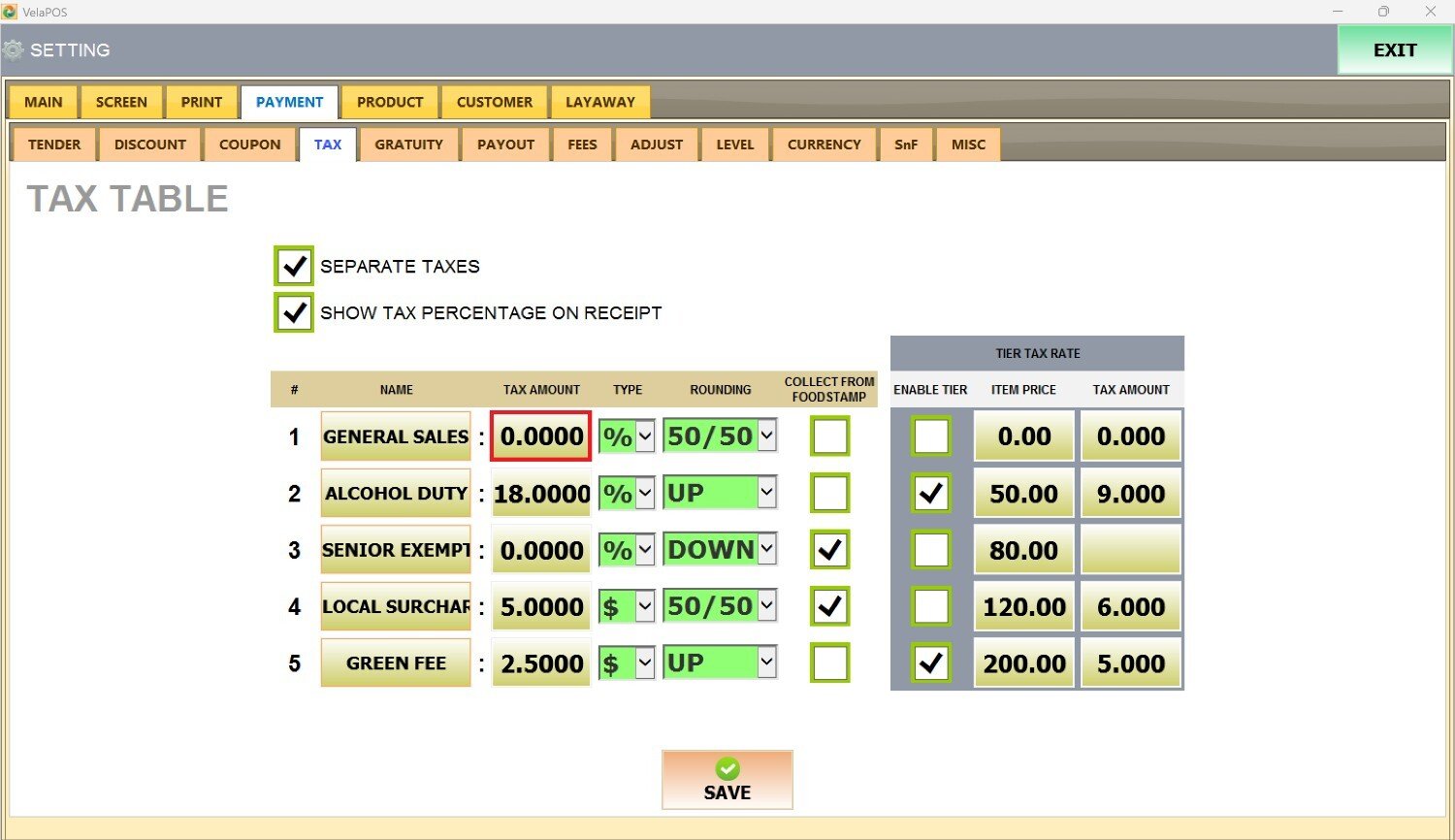

Tax Table Fields

Use this section to create and configure taxes from scratch.

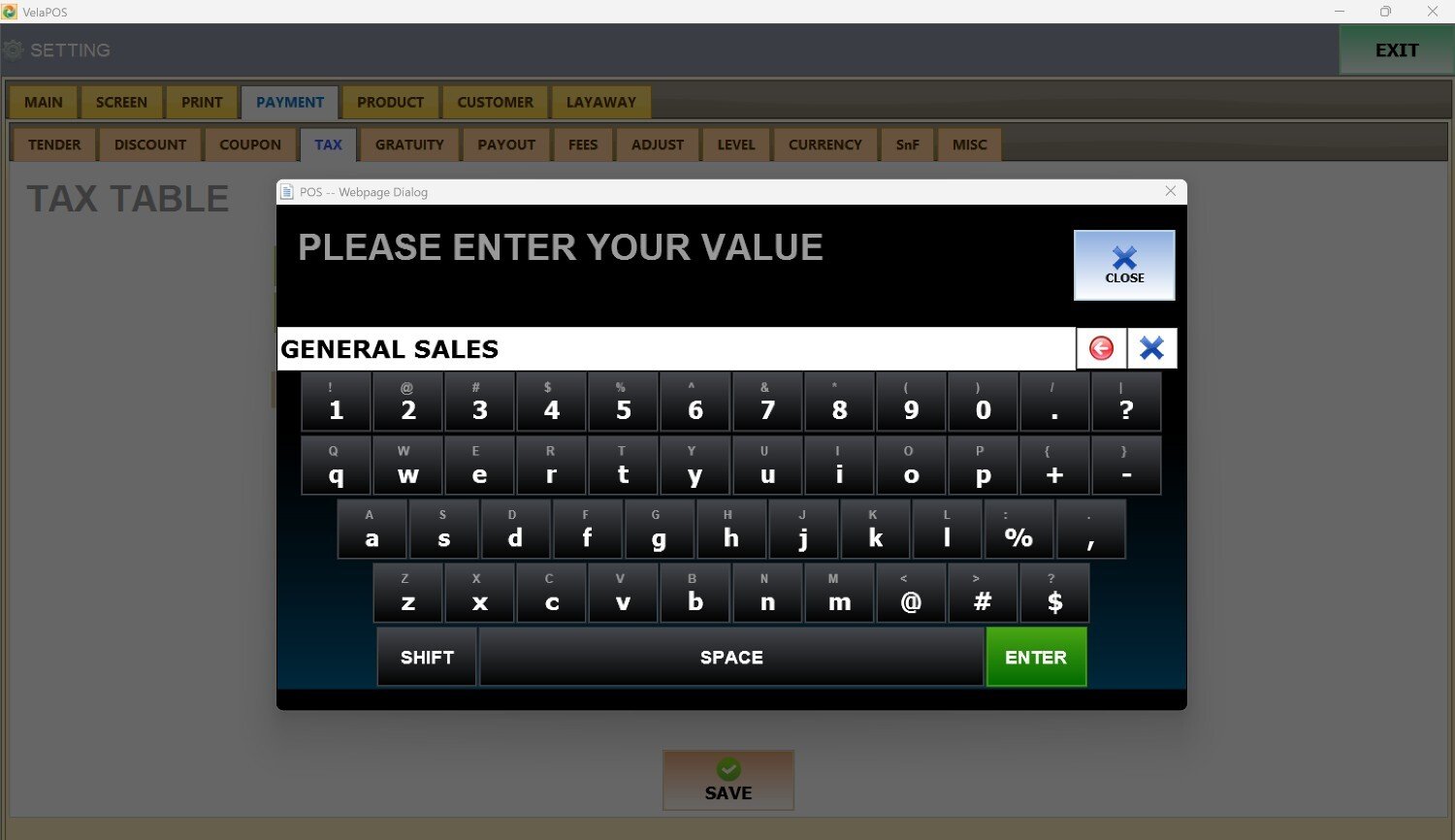

NAME

The label used to identify the tax. Tap the empty field.

Enter the tax name and press ENTER

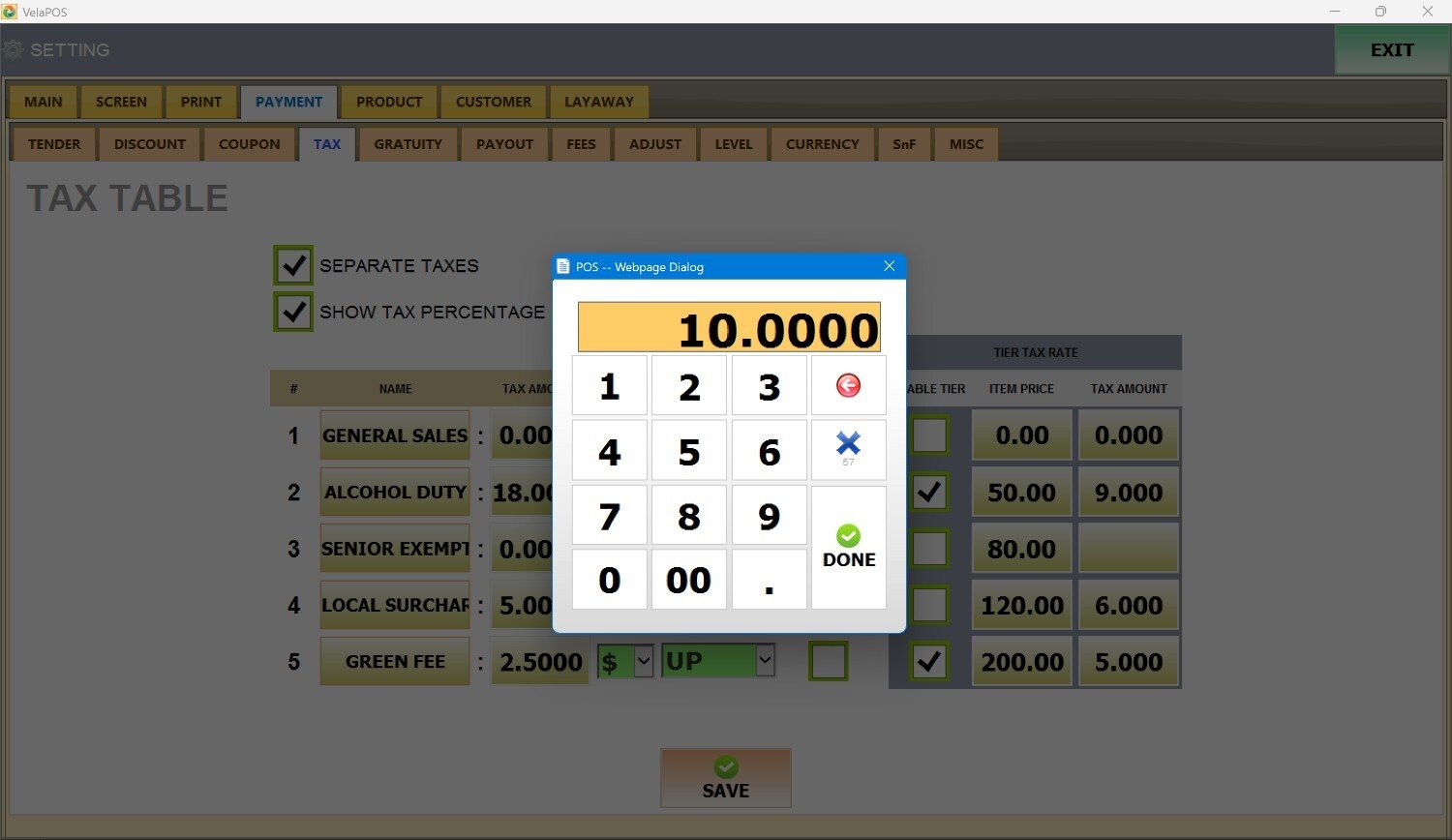

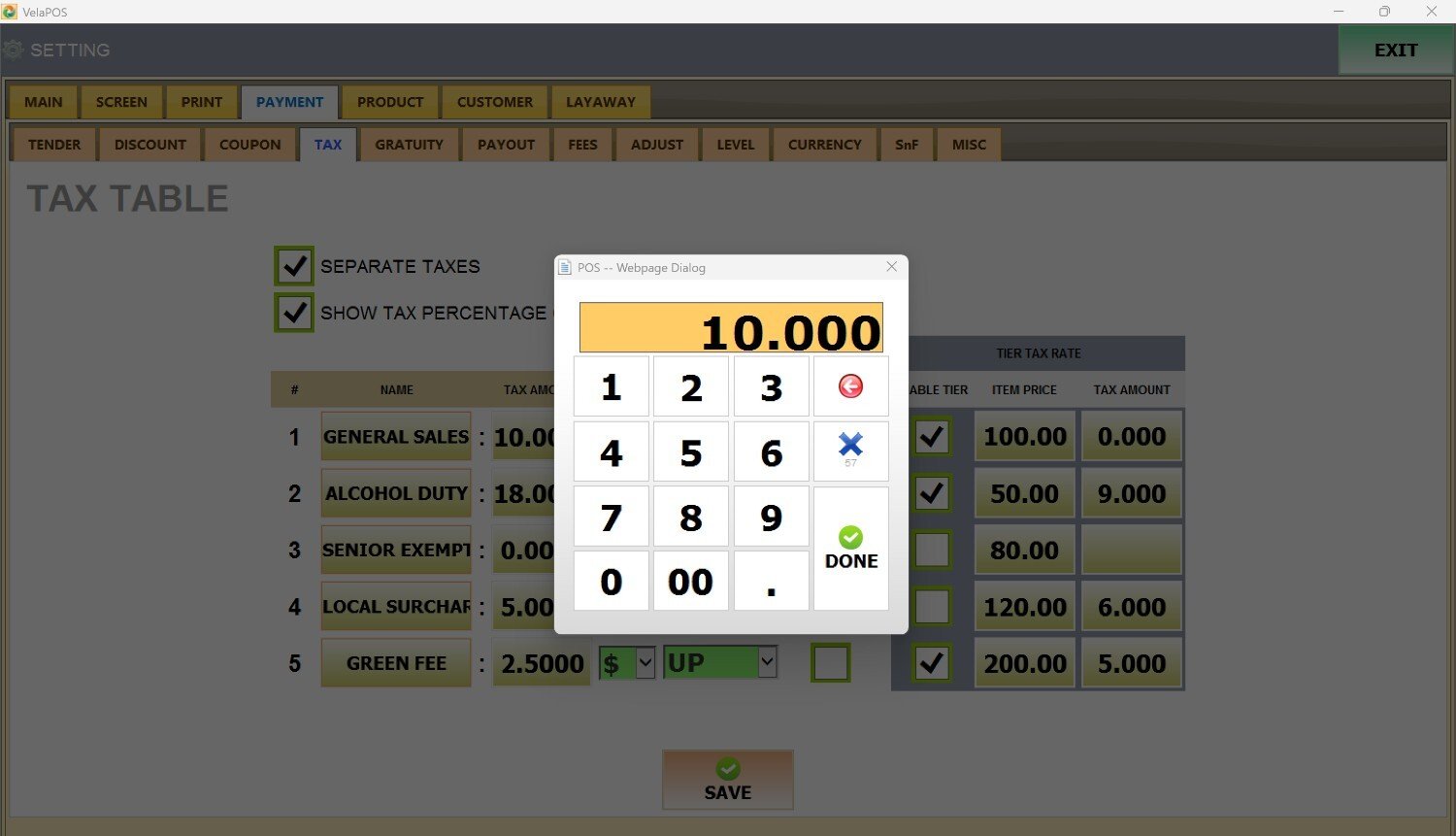

TAX AMOUNT

The percentage or fixed amount applied to the product. Tap the field.

Enter the tax amount and press DONE

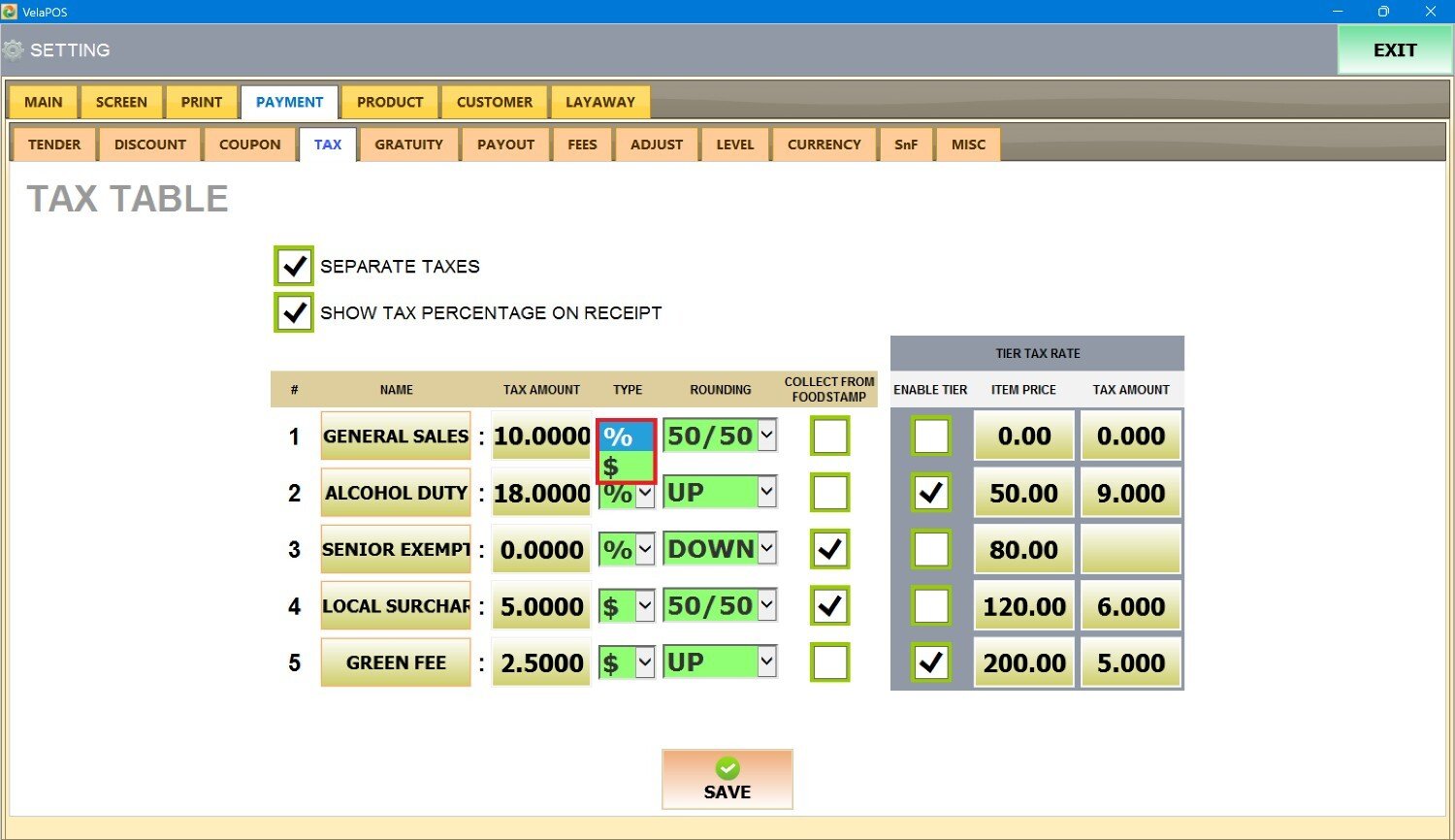

TYPE

Defines whether the tax is applied as a percentage or a fixed dollar amount. In the TYPE column, open the drop-down menu and select Dollar or Percentage.

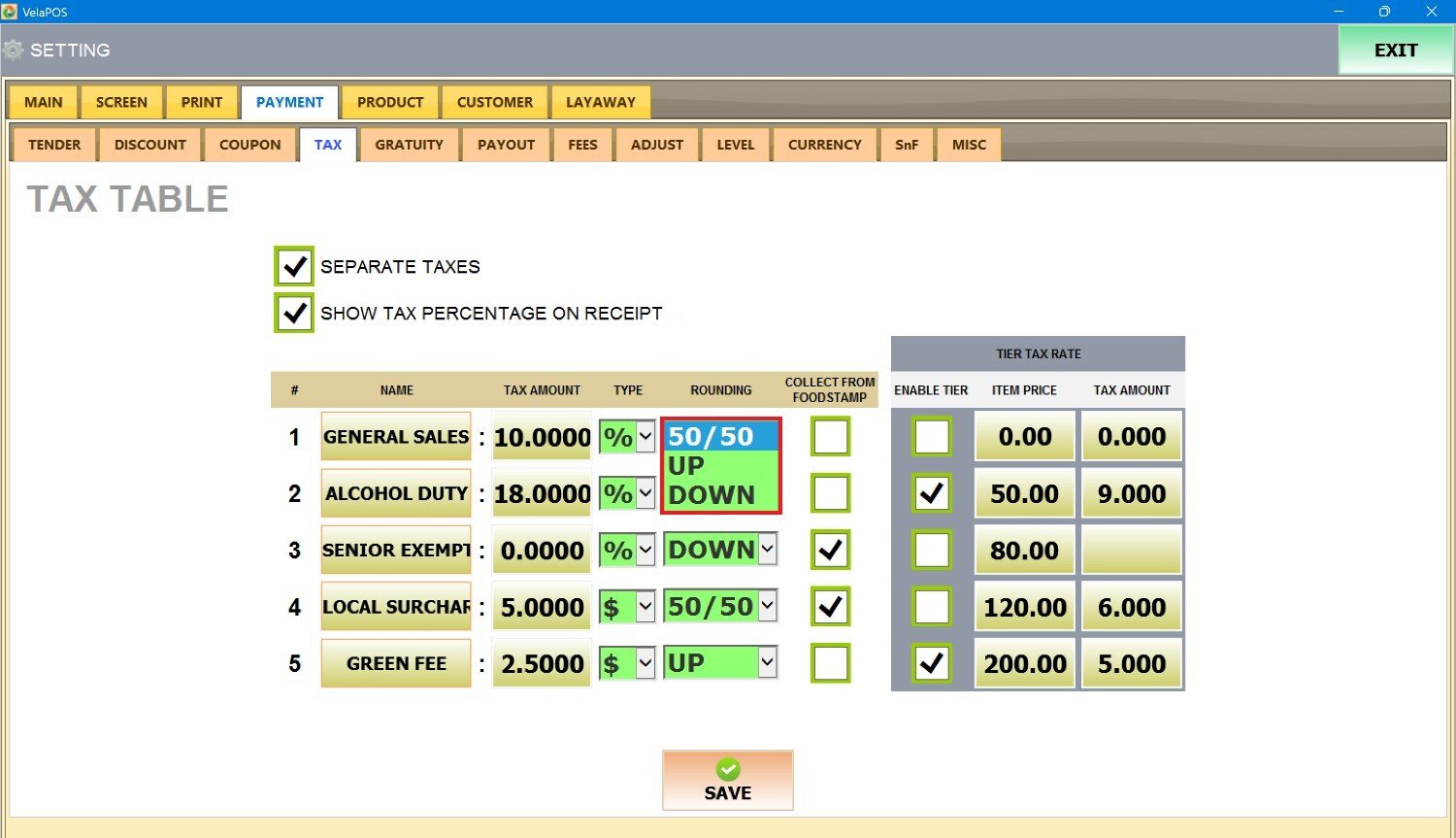

ROUNDING

Determines how the tax amount is rounded.

In the ROUNDING column, open the drop-down menu and select one of the following:

1. 50/50: Standard rounding. Values of 0.5 or higher round up; values below 0.5 round down.

2. UP: Always rounds the tax amount up.

3. DOWN: Always rounds the tax amount down.

COLLECT FROM FOODSTAMP

Controls whether taxes are applied to EBT-eligible items.

If the box is left unchecked, Taxes are excluded during EBT transactions.

When the box is checked, Taxes are still collected on items purchased with EBT.

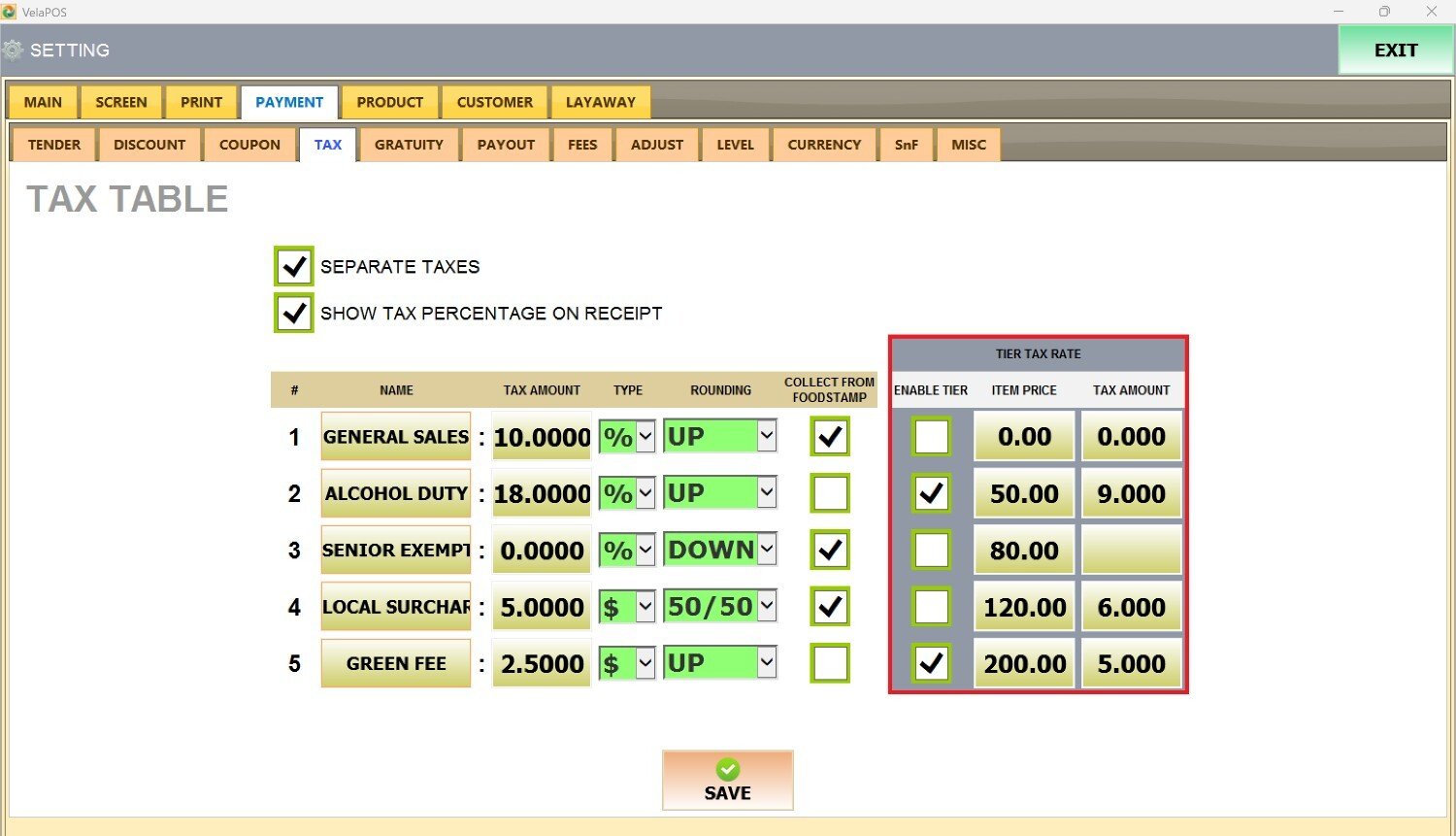

Tier Tax Rate

Allows you to apply an additional tax to items that are already taxed within their category. This is commonly used for higher-priced items that require an extra tax rate based on price tiers.

ENABLE TIER

Check the box to activate the tiered tax rates.

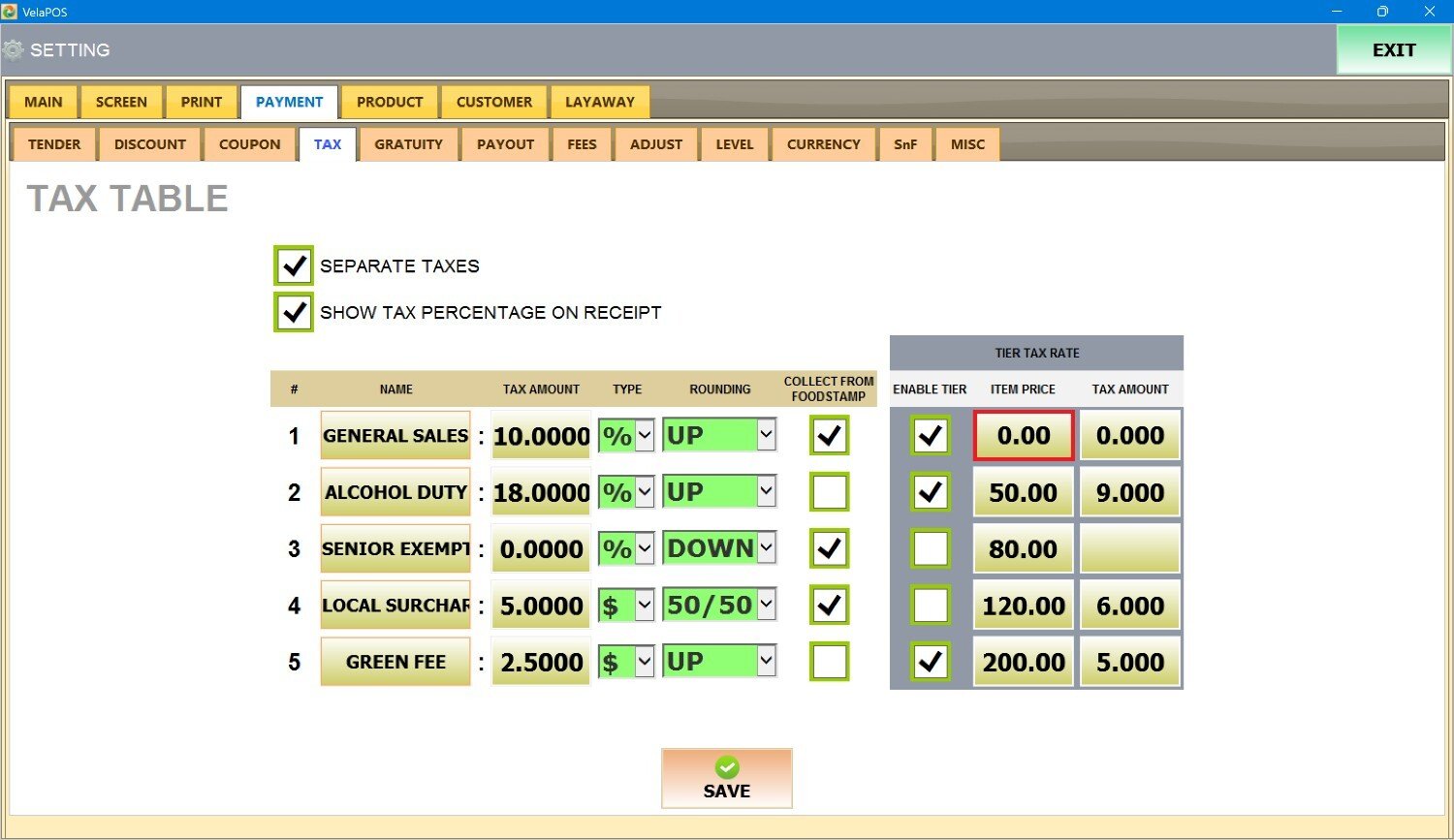

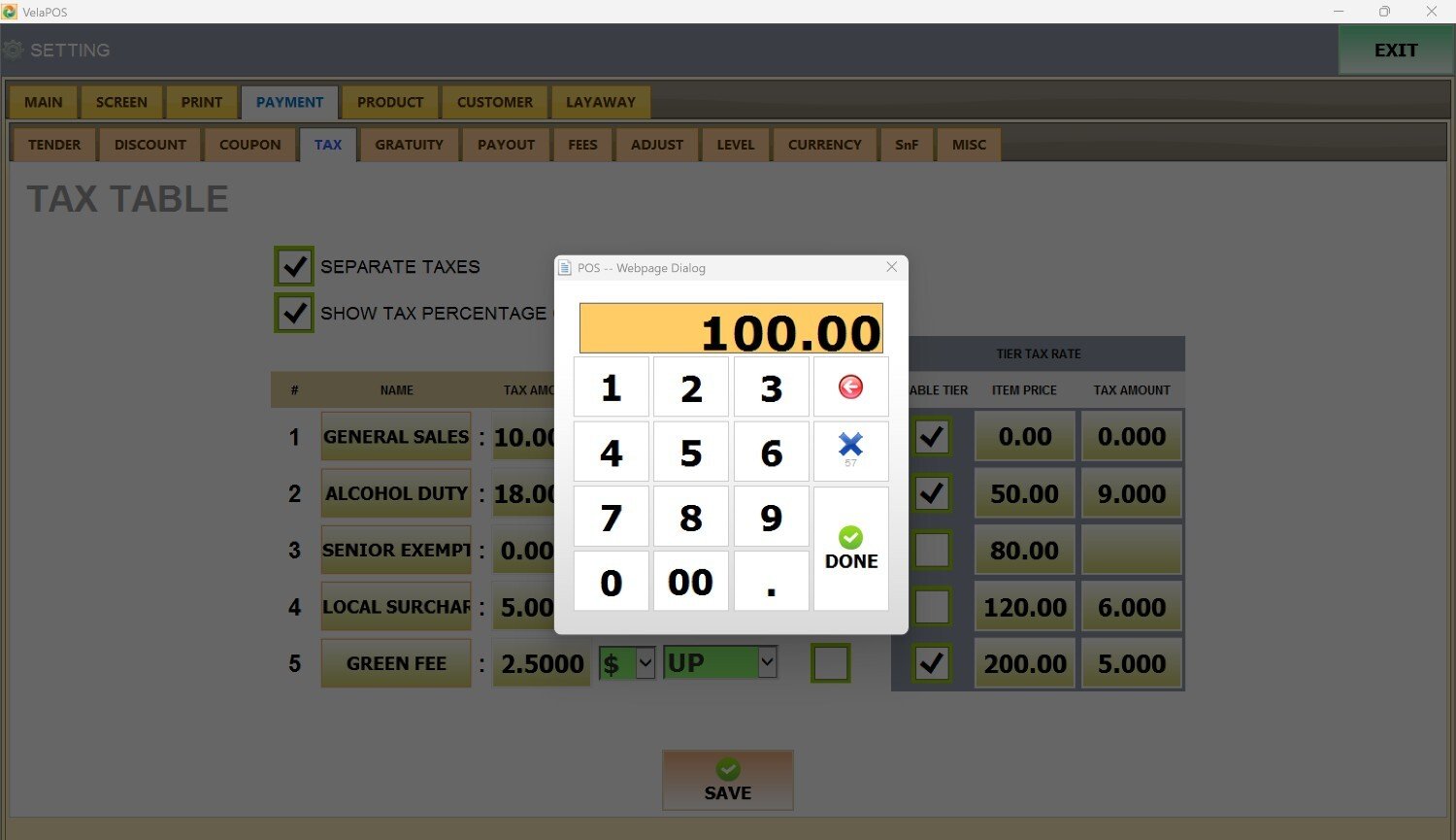

ITEM PRICE

Tap the empty field.

Enter the item price threshold, and press DONE

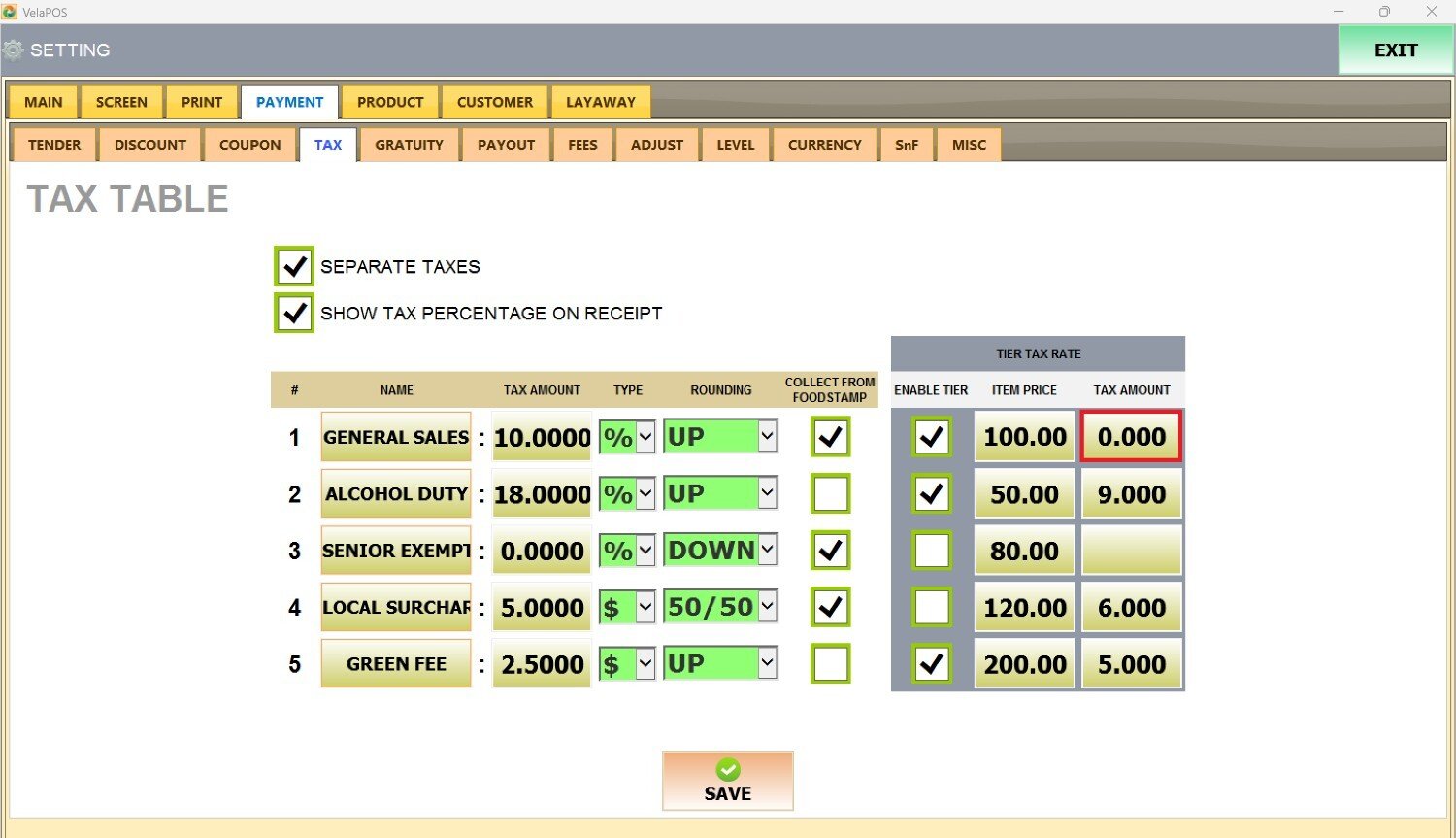

TAX AMOUNT

Tap the empty field.

Enter the tax amount for that tier, and press DONE.

Result:

When an item’s price exceeds the configured threshold (for example, $100), the system automatically applies the additional tax rate (such as 10%) assigned to that tier.

After completing all configurations, press SAVE and RESTART THE PROGRAM to ensure the changes are applied correctly.

Note: To apply taxes to a specific item, refer to Item Tax Setup. To apply taxes to an entire category, see Category Tax Setup.