Taxable (Item Tax Setup)

This function allows you to assign tax rates to individual items.

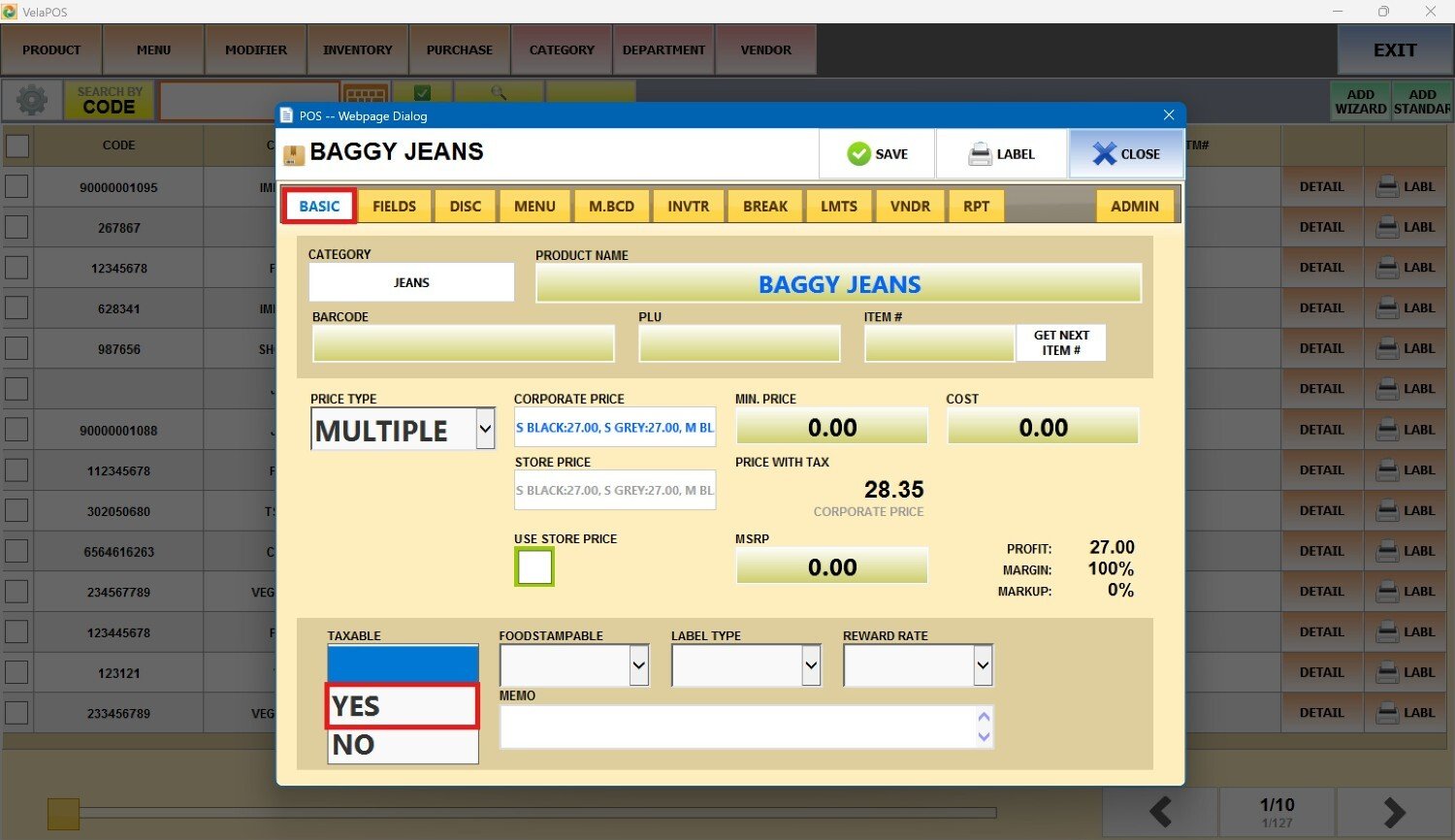

Main Screen> MENU> PRODUCTS> Product's DETAIL> BASIC tab

Go to MENU and press on PRODUCTS

In the PRODUCT section, press on the product DETAIL.

On TAXABLE, you have 3 configurations possible:

1. BLANK: The blank option will follow the product's category configuration.

2. YES: Enables the tax options, allowing you to override the category selection and apply specific taxes for this product.

3. NO: Disables the taxes for this product, overriding the category configurations.

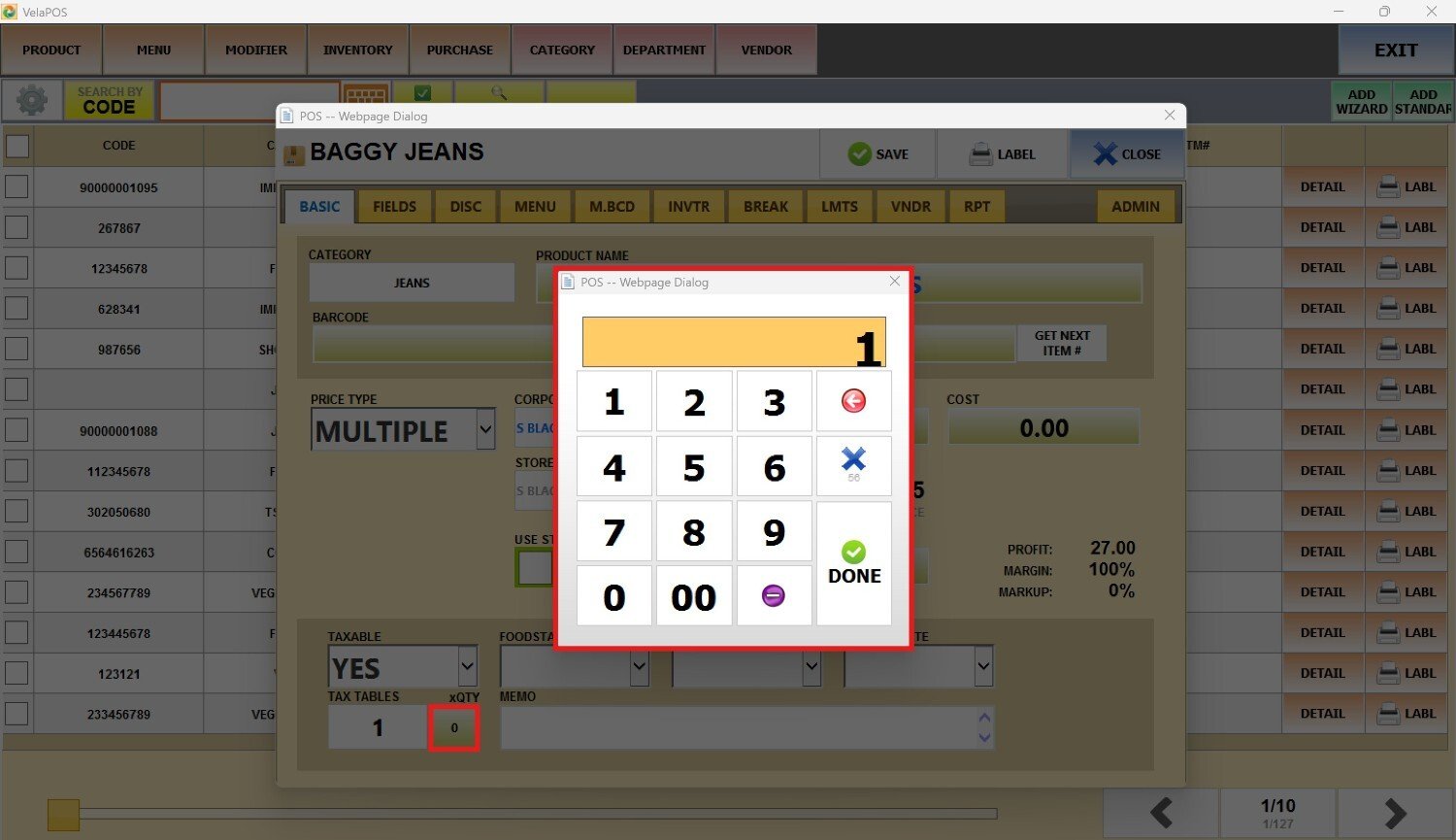

Once the TAX TABLE is enabled, press on the blank field to open a list of available tax rates.

Select the one that corresponds and press OK to continue.

Note: If you don't see a list of taxes, refer to Tax Table to set them.

Use the QTY box, next to the TAX TABLE field, to enter the minimum quantity of the item required on a sale for the tax to apply.

After selecting the corresponding taxes and quantity details, press SAVE to confirm and apply the changes.

Result:

The tax is applied to the product when it is rang up on the sales screen.

Note: To set taxes for a whole category, refer to Category Tax Setup.